Invoice Finance falls into 3 main categories:-

• Factoring

• Invoice Discounting

• Single Invoice Finance (also known as Selective Invoice Finance or Spot Factoring)

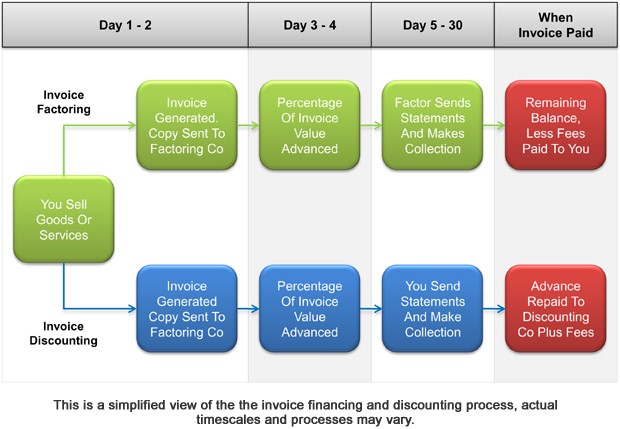

How does invoice finance work? (see graphic below for a simplified visual guide)

The concept is straightforward. Instead of having to wait weeks for your invoices to be paid by your customers, the invoice finance company (lender) will advance you most of the VAT inclusive value immediately, should you request it. That means you have access to the money from completed work immediately, so you can focus on running your business.

If you regularly invoice business customers, invoice finance could suit your company. It is one of the best ways to ease cashflow problems. The options all share the principle of making funds available same day against outstanding invoices, but with the unique features below:-

Benefits of Factoring

- Bridges the cash flow gap between paying suppliers and getting paid

- Credit control expertise helps to reduce in-house overheads and improve collection times

- More flexible than overdrafts and bank loans, as funding grows in line with the sales ledger

- Credit protection can safeguard against debtor insolvency or protracted default

- Improved cash position can help you secure supplier discounts

Benefits of Invoice Discounting

- Bridges the cash flow gap between paying suppliers and getting paid

- You keep your credit control function in-house to build on customer relationships

- Confidentiality means the invoice discounting company’s involvement is not visible to your customers

- The funding available grows in line with the business

- Credit protection can be incorporated to safeguard cash flow against the threat of debtor insolvency and protracted default

- Access to cash can help you secure early settlement discounts with suppliers

- Can be used to leverage additional funding

Benefits of Single Invoice Finance

- Provides fast access to cash tied up in unpaid invoices

- You won’t be tied in to any funding facility or contract

- Great for high-value invoices or those with long payment terms that you would not necessarily have the ability to fulfil without instant access to the cash

- Allows you to retain control of your credit management, thus maintaining your customer relationships

- Funding is based on your customers’ creditworthiness, which can be particularly beneficial if you’re newly starting out or your business has a weak credit history

A simplified view of how invoice finance works.